Cal Arts Electric Vehicle Purchase Incentive 2024

Cal Arts Electric Vehicle Purchase Incentive 2024. Qualifying vehicles must meet specific rules. A $7,500 tax credit for electric vehicles has seen substantial changes in 2024.

People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks. Yes, some evs will qualify for the federal tax credit of up to $7,500 or up to $4,000 for a used ev beginning in 2023.

As Electric Vehicles Continue To Evolve, So Too Are The Tax Incentives That Come Along With Them.

People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

For Example, If You Look Up Tesla's Model 3, On Tesla.com, You.

It should be easier to get because it’s now available as an instant rebate at.

Use Our Guide Below To Learn About The Rebate Program And Other.

Images References :

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, The current california ev rebate is being phased out and will soon be replaced by the clean cars 4 all program. It should be easier to get because it's now available as an instant rebate at.

Source: www.c2es.org

Source: www.c2es.org

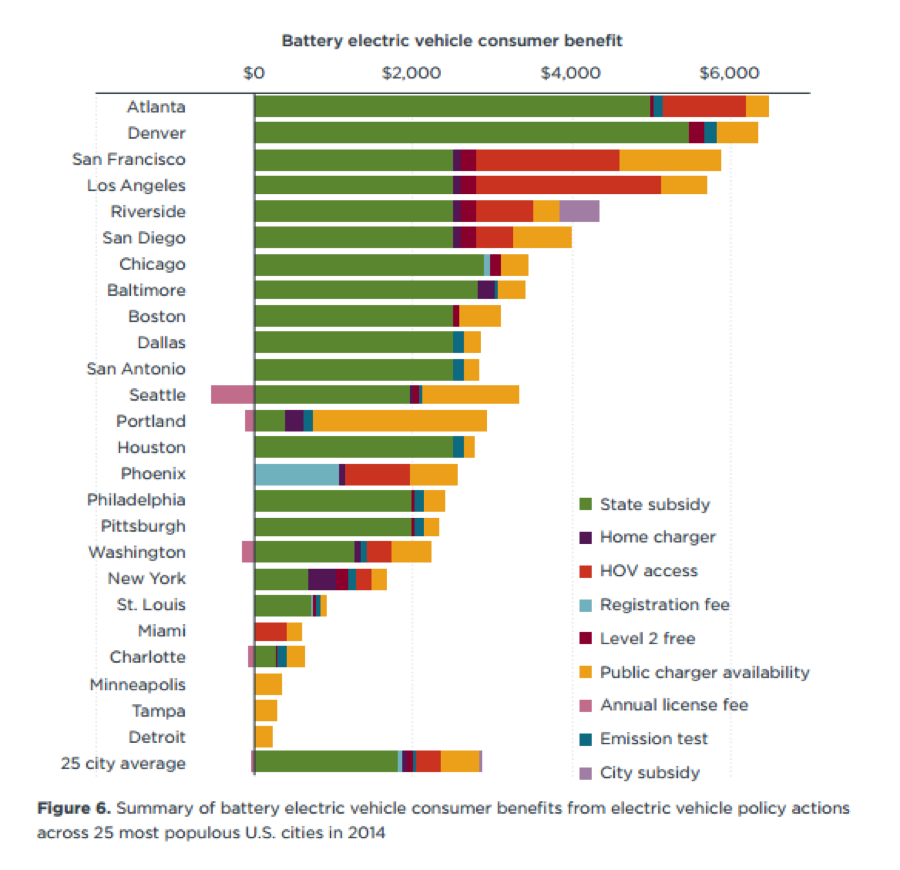

US cities offer diverse incentives for electric vehicles — Center for, Battery electric 12% market share; For example, if you look up tesla's model 3, on tesla.com, you.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks. Incentives goes down to €2,000 if list price.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, For example, if you look up tesla's model 3, on tesla.com, you. The state of minnesota offers a rebate up to $2,500 for a new electric vehicle purchase or lease under $55,000, and up to $600 for a used electric vehicle.

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, And we’re here to take a look at the ev purchasing. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, Upcoming ev rebates & incentives. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, As electric vehicles continue to evolve, so too are the tax incentives that come along with them. And we’re here to take a look at the ev purchasing.

Source: blog.burnsmcd.com

Source: blog.burnsmcd.com

Which Incentives Are Driving Electric Vehicle Adoption?, Battery electric 12% market share; Yes, the revised 2024 ev tax credits still count if you lease the car.

![Electric Motorcycle Incentives 2023 [USA Edition] Damon Motorcycles](https://damon.com/blog/wp-content/uploads/2022/09/Electric-Motorcycle-Incentives-and-Grants.jpg) Source: damon.com

Source: damon.com

Electric Motorcycle Incentives 2023 [USA Edition] Damon Motorcycles, The current california ev rebate is being phased out and will soon be replaced by the clean cars 4 all program. It should be easier to get because it's now available as an instant rebate at.

Source: www.viettonkinconsulting.com

Source: www.viettonkinconsulting.com

Electric vehicles The race between China and The US markets Viettonkin, The current california ev rebate is being phased out and will soon be replaced by the clean cars 4 all program. As electric vehicles continue to evolve, so too are the tax incentives that come along with them.

Yes, Some Evs Will Qualify For The Federal Tax Credit Of Up To $7,500 Or Up To $4,000 For A Used Ev Beginning In 2023.

A $7,500 tax credit for electric vehicles has seen substantial changes in 2024.

Use Our Guide Below To Learn About The Rebate Program And Other.

Yes, the revised 2024 ev tax credits still count if you lease the car.